Family Emergency Blog

15 Essential Steps to Prepare for Family Emergencies: Your Comprehensive Guide to Getting Your Affairs in Order

Family emergencies can occur at any time, catching us off guard and unprepared. It's not something anyone wants to think about, but it's crucial to be ready for the unexpected. That's why it's important to get your affairs in order ahead of time. In this step-by-step guide, we'll show you how to prepare for any unforeseen emergencies that may arise. From serious illness diagnoses to hospitalizations, incapacitation or even death, being prepared can bring peace of mind to you and your loved ones. So, let's dive into how to get your affairs in order and be ready for whatever life may throw your way.

Step 1: Gather Important Documents

Create a checklist for your important documents, including your will, insurance policies, birth certificate, Social Security card, and other legal and financial documents you may have. The checklist will help you identify what's missing from your in case of emergency plan. Gather, categorize, file and securely store important information so you and your emergency contact can locate what's needed in an emergency.

Step 2: Make a List of Your Accounts

Make a list of all of your financial accounts, including bank accounts, investment accounts, and credit cards. Include the account numbers and contact information for each account.

Step 3: Prepare a List of Medications

Prepare a list of your medications and dosages. Also, include any allergies or medical conditions that may be relevant.

Step 4: Create a List of Emergency Contacts

Create a list of your emergency contacts who should be notified in case of an emergency. Include the names and phone numbers of your immediate family members, your doctor, lawyer, and anyone else who should be contacted in case of an emergency.

Step 5: Write Down Your Wishes

Write down your wishes for medical care and end-of-life decisions, such as whether or not you want to be resuscitated, your preferred medical treatments, and any other instructions you want to give to your loved ones. Ask your doctor or attorney to provide you with information and forms to complete a living will, advance directive, health care power of attorney and do not resuscitate order (DNR), if you choose. A letter of instruction and will are typically used to express end-of-life wishes as well. Consult an estate planning attorney to learn more.

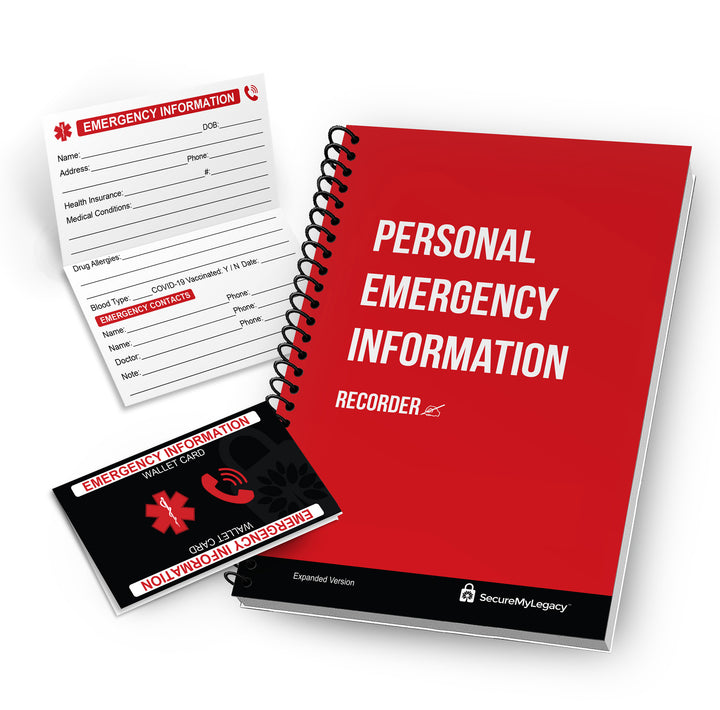

Step 6: Record Your Personal Information

Record your personal information, including your full name, date of birth, and Social Security number.

Step 7: Make a List of Your Digital Assets

Make a list of your digital assets, including usernames and passwords for online accounts, such as social media, email, and banking.

Step 8: Prepare a List of Retirement Accounts

Prepare a list of your retirement accounts, such as 401(k)s, IRAs, and pensions, including account numbers and contact information.

Step 9: Create a List of Life Insurance Policies

Create a list of your life insurance policies, including the policy number and contact information for your insurance provider.

Step 10: Record Your Outstanding Debts

Record your outstanding debts, including mortgages, car loans, and credit card debt.

Step 11: Write Down Your Funeral and Burial Preferences

Write down your funeral and burial preferences, including any specific requests you may have.

Step 12: Create a Plan for the Care of Dependents

Create a plan for the care of any dependents, including children, elderly parents, or pets. Speak to your attorney about designating a guardian through a will or written declaration.

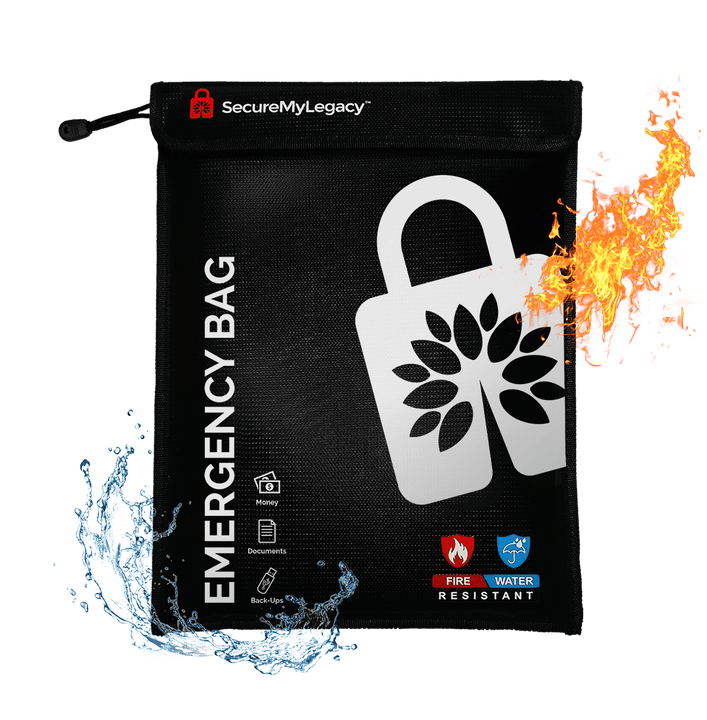

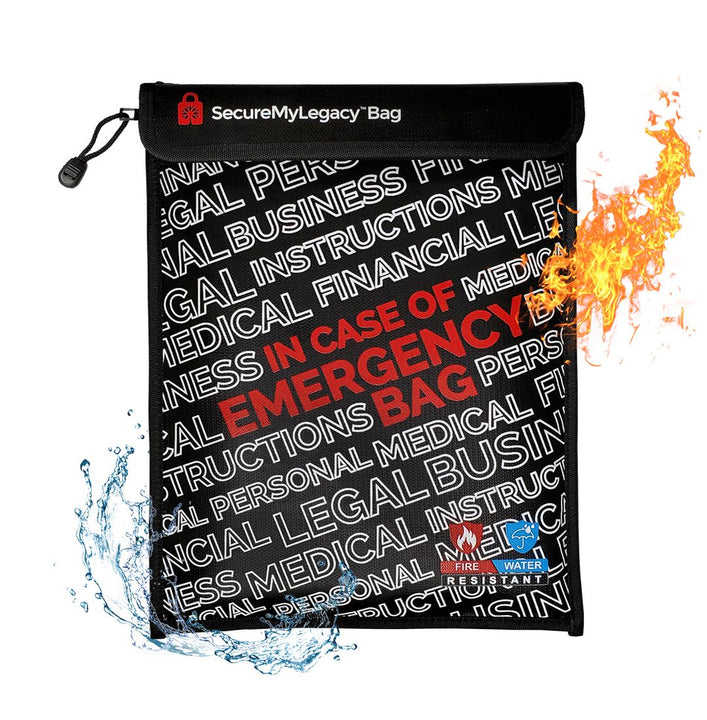

Step 13: Store Your Documents Securely

To keep your important documents and information safe, store them in a secure location, such as a safe deposit box or a home safe. Note that if you choose to store your emergency information in a safe deposit box, your emergency contact may need a court order to access it if they are not listed on the account. To avoid this, add a trusted emergency contact to the safe deposit box account. This ensures they can access the information quickly in an emergency.

Step 14: Share Your Plan with Trusted Individuals

After creating an emergency information plan, which includes gathering important documents such as estate plans, life insurance policies, health care directives, trust documents, medical records, health insurance information, and financial information, it's important to share where you have stored this information and how to access it (e.g., safe code, location of key) with trusted individuals such as family members, close friends, and your attorney. This will ensure that they have access to it in case of an emergency.

Step 15: Review and Update Regularly

Review and update your emergency information plan and beneficiaries listed in your will, trust, retirement plan, bank accounts, investment accounts, annuity and life insurance policy regularly to ensure that it reflects any changes in your life.

By following these 15 steps, you can create an emergency information plan and have critical in case of emergency documents together that will help your loved ones navigate any unexpected emergencies with ease. Don't wait until it's too late - start preparing today.

Posted by Securemylegacy.com – Products for Family Emergency Preparedness